Year-ender: Major economic events in China

chinadaily.com.cn| Updated: Dec 20, 2019

Management of foreign-invested insurance and of banking firms

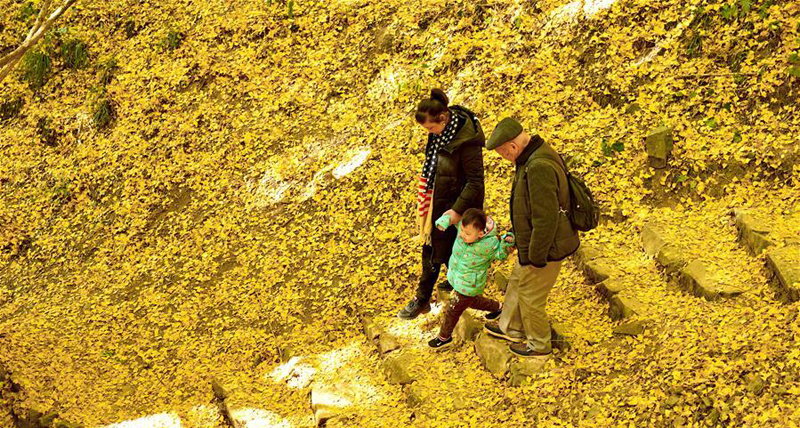

Foreign banks no longer need to get prior approvals for conducting renminbi businesses, and are allowed to underwrite government bonds and conduct certain agent services. [Photo/VCG]

The State Council announced to revise the regulations on management of foreign-invested insurance and of banking firms on Oct 15, and said the revisions would be implemented immediately on the date of their release.

The revisions, which are aimed at providing better legal guarantee to opening up the country's insurance and banking sectors to overseas investors, include improving the supervision over foreign banks' local branches and lifting previous restrictions on company establishment, shareholder status and business expansion.

Foreign insurance groups are now allowed to set up foreign-funded insurance firms in the Chinese mainland, while overseas financial institutions can be shareholders of foreign-funded insurance firms.

In the banking sector, foreign players can establish branches and wholly foreign-owned banks at the same time in the Chinese mainland, as well as setting up branches and Sino-foreign joint ventures simultaneously.

Foreign banks no longer need to get prior approvals for conducting renminbi businesses, and are allowed to underwrite government bonds and do certain agent services.

Meanwhile, the floor limit for foreign bank branches in the mainland to take Chinese citizens' time deposit has been lowered from 1 million yuan ($141,400) to 500,000 yuan.

play

play