Sportswear firm Anta bets big on basketball

By Wang Zhuoqiong| China Daily| Updated: Jul 24, 2019

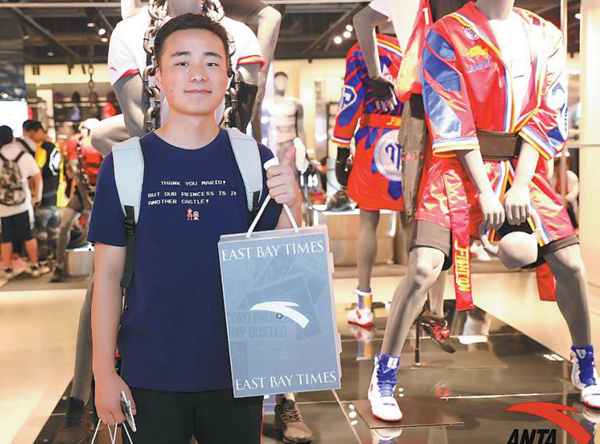

A customer gets a pair of Anta limited edition basketball sneakers minutes after their launch at a store in Shanghai on July 13. [Photo provided to China Daily]

Product designs inspired by personalities and life stories of famous players prove a hit with young Chinese consumers

At the newly renovated retail store of Anta Sports Co Ltd in Yuyuan Garden, Shanghai's oldest shopping and tourism site, the latest Klay Thompson shoes were sold out hours after their launch on July 13.

The limited-edition East Bay Times-themed shoes got their name from the NBA basketball player's habit of reading the newspaper and are decorated with clippings.

About 10,000 pairs - each priced at 999 yuan ($145) - were sold out at Anta's 66 stores nationwide in a day.

In the United States, where only 200 pairs of Thompson's KT4 newspaper-inspired shoes were available, about 200 people lined up at the Oaklandish store on Broadway in Oakland on July 7.

They sold out quickly and were soon being offered on the secondary market for $2,500, about $2,300 more than they originally cost.

The shoes are the fourth generation of Anta's collaboration with Thompson and are proof of how the company's strategy change has elevated Anta's basketball section.

For many domestic sportswear companies, dominating the basketball segment means dominating the whole market. Zhang Yi, CEO of iimedia Research, said domestic sportswear brands' investment in basketball is an investment in young people's immense consumption potential.

Xiamen-based Anta Sports made its basketball unit its first sports category to run independently within the Anta brand since 2014.

It means the basketball unit is responsible for all sectors of business - from planning, design and manufacturing to marketing, retailing and supply chain.

The objectives of operating by category are to give power and control to each category so that they can focus on the consumer groups with most potential, said Christina Li, vice-president of Anta Group. But innovation takes painstaking effort.

"We have to motivate and mobilize all resources from different departments to work collectively for our basketball category," said Cai Zhiben, head of Anta's basketball unit.

The company has expanded its Anta branded network and customer base by being positioned as an affordable brand. Cai said after intensive research, they decided to focus on young college students.

"Once we know to whom we are selling, everything becomes easier and more focused," he said.

Cai said concentrating on a certain age group has strengthened penetration, made marketing more precise, and pricing more accurate, resulting in more visible financial returns.

One of the biggest innovations of the basketball unit is to develop limited-edition products - a price range and product type that Anta had never tried previously.

Cai said product designs were inspired by the personalities and life stories of players.

"Young consumers love the players and they have an emotional connection with what the player wears," said Cai. "They are willing to pay for good design and products that are worth competing for."

In 2018, Anta sold 4 million pairs of basketball shoes, ranking No 1 in the market. This year sales of KT shoes are expected to reach 1 million pairs.

In addition to the KT series, Anta basketball has rolled out a continuous product portfolio including products featuring rising basketball player Gordon Hayward of the Boston Celtics. Hayward is expected to tour with Anta in several cities next month.

Seeing the success of the basketball unit, since the end of last year, Anta has restructured to create independent training, running and sports life units.

The initiative has shown Anta's determination to help brands be more flexible and respond more quickly to consumer and market needs, said Li.

Last year, Anta's collaboration with NASA led to sales of 10,000 pairs of shoes. This year, Anta has joined hands with leading brands including Marvel, Coca-Cola, and the Palace Museum, resulting in a strong sales performance.

First half financial reports show the retail revenue of Anta-branded products has grown 10 to 20 percent and its other brands have increased 60 to 65 percent compared with the same period last year.

To attract younger consumers, Anta has renovated its retail stores to include screens, multiple floors and localized content.

The first floor of the three-story, 3,000-square-meter flagship store in Yuyuan Garden is dedicated to limited-edition brands and localized content or collaborations with renowned designers.

The second floor hosts AntapluS, a high-end lifestyle yoga brand and Anta Kids. The top floor serves as an outlet offering affordable products to those who focus on function and are more price sensitive.

Liu Chong, deputy director of the Anta retail center, said communicating with young consumers is key to store layout and design. For example, the KT shoe display section has become an attraction for young consumers to visit, take photos and order personalized designs.

Anta Sports' rise came after a series of mergers and acquisitions of leading international sports brands. A consortium led by Anta Sports completed the purchase of Finnish sporting goods company Amer Sports on April 11, making Anta the world's third-largest sportswear maker by market value after Adidas and Nike.

The group itself owns a wide range of world-leading brands through frequent acquisitions, including Arc'teryx, Fila, Descente and Sprandi.

play

play